Understanding cash flow is one of the most important aspects of running a successful business. Familiarizing yourself with where your money is coming from, where it is going and how much you need readily accessible is crucial if you want to maintain positive relationships with suppliers and employees, provide consistent products and services, and avoid going into unnecessary debt.

cash flow (noun)

the total amount of money being transferred into and out of a business, especially as affecting liquidity

“last month’s sales volume lead to a positive cash flow"

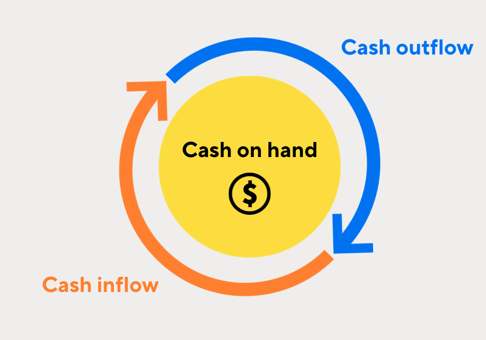

The cash flow cycle

The cash flow cycle involves three elements: inflows, outflows and the amount of cash you have on hand. Creating a balance between these line items on your Cash Flow Worksheet will help you understand net cash increases and decreases and eliminate situations where your necessary expenditures are greater than your available funds.

Cash inflows

Inflows are any cash coming into your business, which are broken down into these categories:

- Financing: Borrowed money

- Operations: Collected payment for services or goods provided (sales)

- Investing: Income earned from investment activities

Cash outflows

Outflows are any money going out of your business, like operating supplies, payroll, loan payments and new investments.

Cash on hand

Just as it sounds, cash on hand is the money you currently have available to use for your business.

Realistic cash flow management involves recognizing when and where outflows happen and reducing or eliminating cash flow gaps.

Often, cash outflows happen before your inflows can cover them. Perhaps terms require you to wait 30 days to collect payment after providing a service or maybe you need to purchase assets or inventory before you can fulfill the sales that will pay for them. While you may eventually end up back in the black after expected cash inflows, these types of cash flow gaps can create serious financial problems.

For example, Craig, who owns a contracting business, uses his own cash to buy $30,000 in materials to start a new construction job. He finishes the work, submits the invoice and receives payment 30 days after the job is done. Therefore, Craig had to go $30,000 in the red before his business is paid; the cash outflow happened before the inflow was able to cover it.

Cash flow components

You need to understand the components that can positively and negatively influence your cash flow.

- Accounts receivable: sales value of goods and/or services you’ve provided that the customer has not paid for yet

- Accounts payable: money you owe to your suppliers that are due for payment

- Payment term: time limit that you set for customers to pay

- Credit policy: guidelines you use when deciding whether or not to extend credit to a customer and the terms

- Inventory: supplies or products your business keeps on hand to meet sales demands

Once you understand the components that impact cash flow, you’ll be able to identify ways to adjust them, minimizing gaps that could potentially harm your business.

Creating a cash flow forecast

A cash flow forecast is a prediction of your business’ cash flow over a defined period, usually month over month or quarterly—it’s a way to understand the relationships between the above components.

By creating this forecast, you can identify gaps before they happen and minimize or eliminate them by making a plan to reserve or generate the working capital your business will need. Some common techniques for closing cash flow gaps include re-evaluating inventory procurement, improving account collections or getting a short-term loan, if necessary.

ATB’s Cash Flow Forecast Template can help you produce monthly cash flow projections to build a realistic expectation of your working capital requirements. Create a copy of this template, and follow the steps below to create your business forecast.

Step 1: Sales projections

Project what your sales will look like every month in the sales line. You will then need to enter the Cost of Goods Sold (COGS), which indicates the direct costs you need to incur to produce goods or perform your business’ services. COGS should include any materials and labour used in creating goods and costs to perform services. COGS should not include distribution and sales costs.

Cash inflow consists of the sales line and any capital, including cash from sales, accounts receivable, bank loans and shareholders loans. Ensure you place income in the month it will be received (as opposed to the month it was invoiced for) and enter the most realistic projections possible. While most businesses will have month-to-month variations in revenue, the more realistic your projections are, the more accurate your cash flow forecast will be.

Step 2: Monthly expenses

Take into consideration any expenses your business may incur throughout the year. Cash outflows can include monthly operating expenses (like rent, insurance, inventory purchases and loan repayments) and capital expenses (like equipment purchases). Put each identified expense in the month it will be due to get a more accurate picture of cash flow for that month.

Here are some additional expenses to account for:

- Accounting and bookkeeping costs

- Automotive

- Bank fees

- Business licences

- Communications

- Dues and subscriptions

- Interest and principal payments on loans

- Insurance

- Legal fees

- Office supplies

- Management wages

- Marketing and promotion

- Materials and inventory

- Rent or leasing costs

- Repairs and maintenance

- Taxes

- Travel

- Utilities

- Wages for you

- Wages and benefits for your staff

- Workers’ Compensation Board (WCB) payments

Step 3: Review your forecast

After you’ve calculated your inflows and outflows, your cash flow summary will identify whether your business will be in a surplus (“in the black”) or deficit (“in the red”).

Look at your business’ projected opening and closing bank balance for each month. If the sheet shows a negative figure, you’re projected to be in a deficit position. If it shows a positive figure, you’re projected to stay in the black.

After identifying any potential gaps and creating a realistic forecast, you can build a strategy for a solution. Discuss options—like a short-term loan or line of credit to mitigate shortfalls—with your business advisor.

Tips for closing cash flow gaps

Automate payroll

Automating payroll is one of the easiest ways to ensure your cash on hand is accurate month to month. Instead of manual payroll, use an automated system that is linked to your bookkeeping software. You can also facilitate electronic fund transfers (EFTs) through your bank, so payroll goes directly into your employees’ accounts. Find the right payroll solution for your company with your business advisor.

Automate payment collection

If you receive the majority of payments by cheque, you’re likely aware of the risk of funds being held for processing, causing you to go into overdraft and incur fees. Consider options like Interac e-Transfer or other forms of online payment. Another option is using EFT services to eliminate the waiting period, allowing the funds you receive to be available immediately.

Encourage early payment

Offer customers incentives for early payment or for using guaranteed payment methods like bank drafts or EFTs.

Tips for using surplus funds

After you’ve eliminated any projected cash flow gaps, it’s time to start thinking about using surplus funds to pay down debt or further invest in your business. A guideline is to direct surplus funds towards paying off high-interest debt or buying high-interest investments—whichever interest rate is higher.

Pay down debt

Business debt can hinder long-term growth, so paying down debt with surplus funds is an excellent option if your cash flow gaps are covered. Pay down high-interest loans and financing—like credit cards, trade accounts and short-term loans—first.

If your loan has prepayment penalties, compare those costs with the savings of not paying interest on the loan. Consider that lowering your debt level today will make it possible for you to borrow more should you require financing for future growth.

Build up working capital

If you don’t have much debt or your debt has a lower interest rate, consider using extra funds to build up working capital with short-term investments. By putting funds into Guaranteed Investment Certificates (GICs) or a T-Bill Savings Account, you can earn interest and grow your savings in a secure place.

If you’re not sure when you’ll need to access these funds, consider depositing them into an accessible account. Options include short-term or cashable GICs. With a short-term GIC, your money will be held to earn interest for a specified short period—anywhere from 30 days to five years. With a cashable GIC, you can withdraw your money at any time—but the longer you keep it in, the more interest you will ultimately earn to reinvest into your business or pay out dividends.

Another way to build working capital is to pay down your high-interest credit (outlined above) and invest in production inputs for next year.

Invest

Investing capital is an essential component of business growth. While having funds in your business bank account might feel reassuring, your business can’t grow if those funds aren’t being put to work.

Speak to your business advisor to determine how your investments can have a positive impact on your future cash flow and keep your business on solid financial footing.

Cash flow and banking

With financial projections complete, you can feel confident in understanding your cash flow and how your business can prepare for the best- and worst-case scenarios. You’re now ready to set up the right business banking accounts to support your needs.